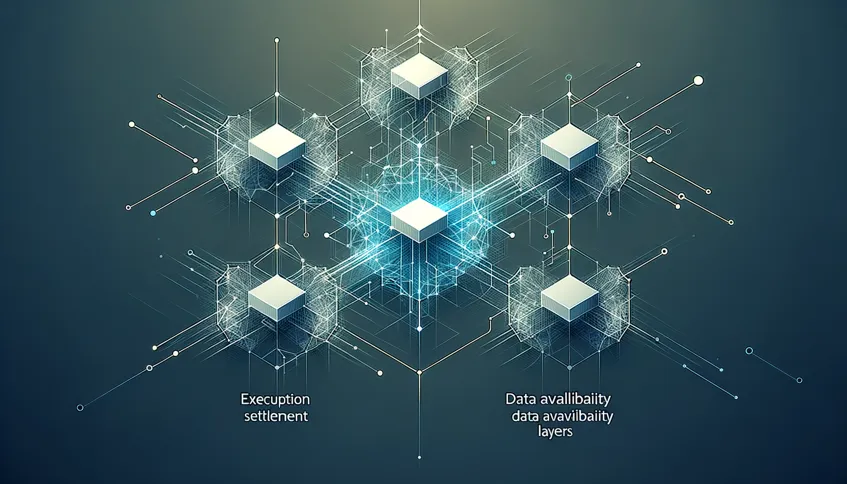

MegaETH Modular Architecture Analysis

Ethereum L2 MegaETH showcases a modular design using EigenDA for data availability, aiming for >1.7 Ggas/s execution via JIT compilation and parallel processing. It decouples execution/settlement/DA, enhancing scalability while preserving EVM compatibility and decentralization, secured by restaked ETH via EigenLayer.

Links:

- https://x.com/PinkBrains_io/status/1914621433017508203

- https://www.coinex.com/en/academy/detail/2152-introducing-the-first-real-time-blockchain-megaeth

MicroStrategy Capital Structure and BTC Yield

MicroStrategy employs convertible debt for BTC acquisition, capitalizing on convexity and volatility attractive for delta-neutral trades. Evaluate their internal "BTC Yield" metric, assessing BTC accumulated per share against dilution. This financial engineering relies heavily on sustained market appetite for MSTR equity/debt issuance and BTC price appreciation.

Links:

Stablecoin Dominance as Market Indicator

Monitor USDT.D and USDC.D charts relative to TOTAL2 (altcoin market cap ex-BTC). Declining stablecoin dominance alongside a rising TOTAL2 suggests capital rotation into altcoins, potentially signaling bullish market sentiment. Note potential regional variations in stablecoin preference due to regulatory pressures (e.g., EU favoring USDC).

Lightning Network Impact on Mempool

Observed reduction in Bitcoin mempool size and transaction fees may correlate with increased Lightning Network adoption. This trend suggests successful off-loading of smaller transactions to L2, improving base layer efficiency and demonstrating the practical scaling benefits of LN for everyday use cases.

Liquid Staking Derivatives Integration in DeFi

Liquid Staking Derivatives (LSDs) are becoming foundational within DeFi ecosystems like Solana (e.g., JitoSOL, mSOL). These allow staked capital to remain liquid, enabling participation in lending protocols, stablecoin collateralization, and DEX liquidity provision, enhancing overall capital efficiency across the DeFi stack.